个人理财的目的

Title: The Significance of Personal Financial Management

Introduction:

Personal financial management refers to the process of planning, organizing, and controlling one's finances in order to achieve financial independence and future stability. In today's fastpaced world, understanding the significance of personal financial management is crucial for individuals to attain their goals and lead a fulfilling life. This article aims to highlight the importance of personal financial management in English.

1. Financial Security:

One of the primary reasons for practicing personal financial management is to attain financial security. By carefully managing income, expenses, and savings, individuals can build an emergency fund to cope with unexpected expenses such as medical emergencies or job loss. This financial cushion provides peace of mind and protects against financial vulnerabilities.

2. Goal Achievement:

Effective personal financial management enables individuals to set and achieve their longterm financial goals. Whether it's purchasing a home, starting a business, or saving for retirement, having a strategic financial plan allows individuals to allocate resources and track progress towards their objectives. By setting specific, measurable, attainable, relevant, and timebound (SMART) goals, individuals can stay focused and motivated.

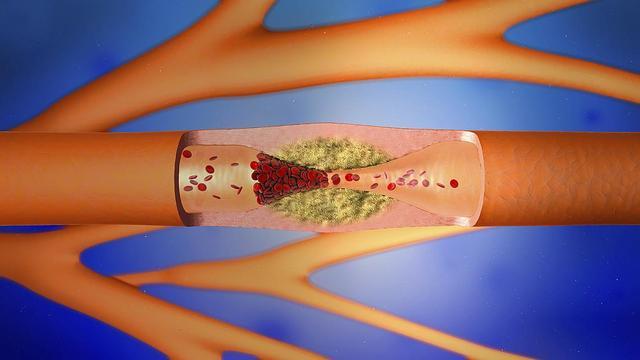

3. Debt Management:

Personal financial management emphasizes the importance of debt management. It helps individuals understand the impacts of excessive debt and encourages them to develop strategies for debt repayment. By creating a budget and prioritizing debt repayment, individuals can alleviate financial stress, improve credit scores, and save money on interest payments.

4. Investment and Wealth Accumulation:

Effective financial management enables individuals to grow their wealth through investment. It encourages individuals to diversify their investment portfolio and make informed decisions based on risk tolerance and financial goals. By understanding investment options such as stocks, bonds, real estate, and mutual funds, individuals can make strategic investments to achieve longterm wealth accumulation.

5. Retirement Planning:

Personal financial management plays a crucial role in retirement planning. It helps individuals estimate their retirement needs, determine the required savings, and choose the appropriate retirement plan or investment vehicles. By starting early and regularly contributing to retirement funds, individuals can build a comfortable nest egg and enjoy a financially secure retirement.

6. Lifestyle Choices:

By practicing personal financial management, individuals gain a better understanding of their spending habits and can make conscious lifestyle choices. It encourages individuals to differentiate between needs and wants, prioritize financial goals, and make informed decisions about spending and saving. This awareness helps individuals maintain a balanced and sustainable lifestyle.

7. Financial Independence:

Personal financial management empowers individuals to achieve financial independence. It allows individuals to break free from financial constraints and make choices based on personal preferences rather than financial limitations. Financial independence provides a sense of control, freedom, and the ability to pursue opportunities without significant monetary constraints.

Conclusion:

In conclusion, personal financial management is of great significance in enabling individuals to attain financial security, achieve goals, manage debt, accumulate wealth, plan for retirement, make conscious lifestyle choices, and achieve overall financial independence. By prioritizing financial literacy, practicing disciplined saving and investing, and seeking professional advice when needed, individuals can gain control over their finances and pave the way for a brighter financial future.

评论